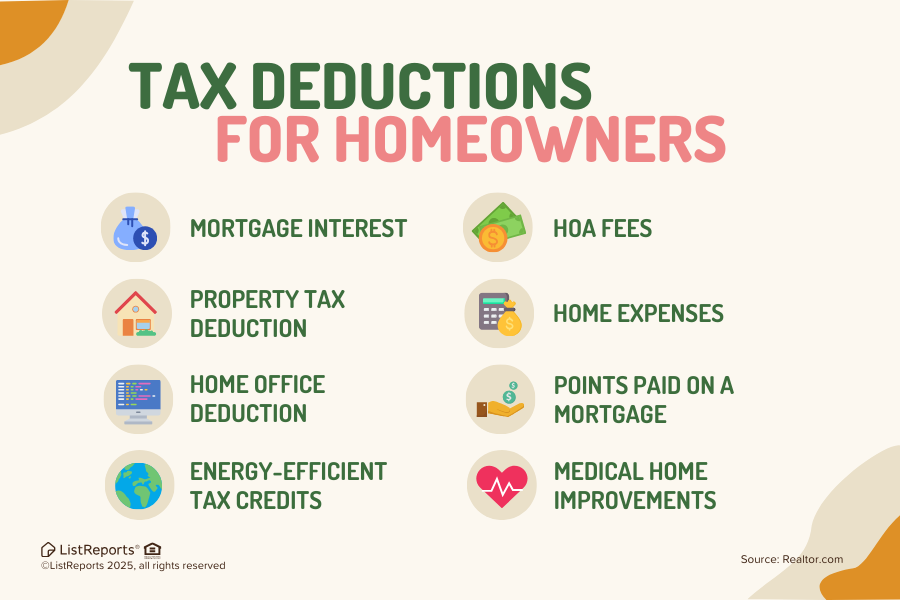

If you own a home or are thinking about buying a home in Northern Virginia, tax season is a great time to understand how your home may impact your finances. Tax deductions for homeowners in Northern Virginia can help offset the cost of owning a home, especially when it comes to mortgage interest, property taxes, and certain home improvements. While every situation is different and tax rules can change, here’s a helpful overview of common homeowner deductions and credits to be aware of.

Mortgage Interest Deduction

Mortgage interest is one of the most well-known tax deductions for homeowners. If you purchased a home in areas like Ashburn, Leesburg, Sterling, or elsewhere in Northern Virginia, the interest you pay on your mortgage may be deductible, subject to IRS limits. This benefit is often most impactful in the early years of homeownership.

Property Tax Deduction

Northern Virginia homeowners typically pay property taxes to their county or town. These property taxes may be deductible, up to federal limits, and can make a noticeable difference at tax time especially for first-time buyers who haven’t experienced this benefit before.

Points Paid on a Mortgage

If you paid points to reduce your interest rate when buying or refinancing your home, those points may also be deductible. Depending on how the loan is structured, the deduction may apply in the year you purchased or over the life of the loan.

Home Office Deduction

For self-employed homeowners who use part of their Northern Virginia home exclusively and regularly for business, a home office deduction may be available. This can include a portion of utilities, insurance, and certain maintenance expenses tied to that space.

Energy-Efficient Tax Credits

Energy-efficient upgrades such as new windows, doors, insulation, or qualifying heating and cooling systems may qualify for federal tax credits. Many Northern Virginia homeowners make these upgrades to improve comfort and efficiency while also benefiting at tax time.

Medical Home Improvements

Some home improvements made for medical reasons, such as accessibility modifications, may be deductible if they meet IRS requirements. These deductions are typically tied to medical necessity rather than resale value.

HOA Fees and General Home Expenses

HOA fees and everyday home expenses are usually not deductible for primary residences. However, there are exceptions for rental properties or homes with qualified business use, which is why it’s important to review your specific situation with a tax professional.

Final Thoughts

Homeownership in Northern Virginia comes with many benefits, and potential tax deductions are one of them. Whether you recently bought a home or are planning to buy or sell, understanding how taxes factor into the bigger picture can help you make smarter real estate decisions.

If you’re thinking about buying, selling, or upgrading a home in Northern Virginia and want to understand how those choices may impact your finances, I’m always happy to help.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link